Top Fintech Trends 2025 – Shaping the Future of Finance

Nauman Pathan

March 18, 2025 77 Views

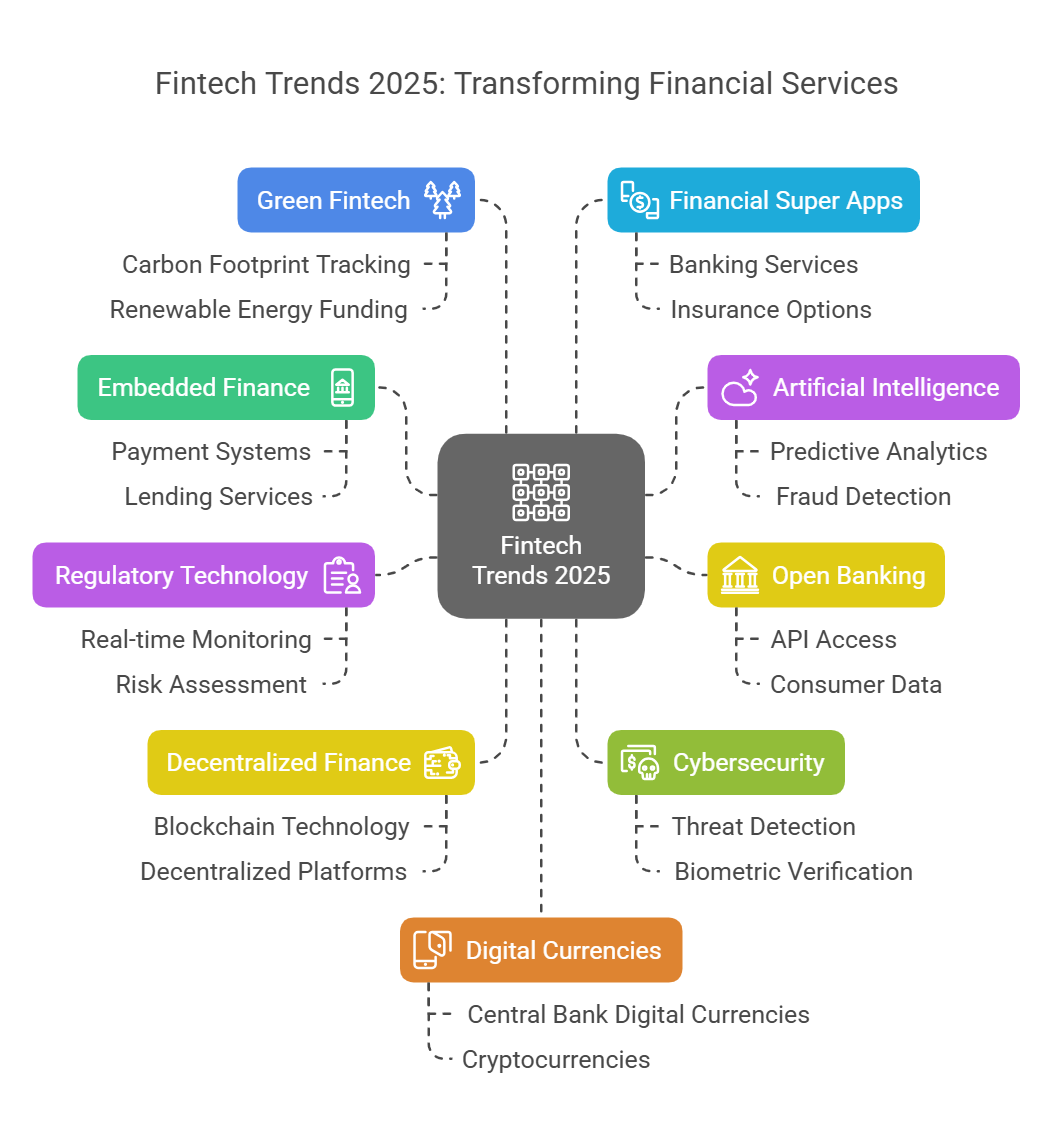

Quick Summary : Key fintech trends of today such as embedded finance, AI-led automation, DeFi, and open banking are reimagining the way financial services work. Financial institutions, for instance, employ artificial intelligence to analyze spending patterns to prevent fraud and create personalized experiences, while decentralized finance is disrupting traditional banking. Mitigating Cybersecurity is still a focal point to keep digital transactions safe. Ongoing advances in regulatory technology are simplifying compliance. These trending developments in fintech offer a glimpse into a future fueled by innovation, security, and less integration in finance.

Today’s fintech trends are not mere technological improvements—they are redefining the finance playbook. Embedded finance, AI-powered automation, and DeFi are redefining traditional banking with faster, wiser, and more open transactions than ever before. Open banking is encouraging collaboration, RegTech is making compliance easier, and cybersecurity is evolving to protect digital assets. As we head towards 2025, these innovations are no longer elective—they are the new norm. If you’re a startup, financial institution, or investor, getting familiar with current trends in fintech is crucial to remain competitive. Let’s take a look at what’s on the horizon to shape the future of financial services.

Companies across the globe are closely monitoring fintech trends, keen to know how fintech industry trends will influence their strategies. Let’s look at the top trends in the fintech industry fueling this explosive growth and reshaping the future of finance.

The Evolution of Fintech in 2025

1. Embedded Finance: Integrating Financial Services into Everyday Platforms

Embedded finance is the effortless integration of financial services into non-financial platforms where businesses can provide banking-like services right within their products. The practice makes it possible for companies to provide services like payments, lending, or insurance without referring customers to external financial institutions. For instance, a ride-sharing application could have its own payment system in place, which makes users avoid using other external payments.

This integration promotes customer experience through convenience and simplification of transactions. The global embedded finance market is estimated to hit $384.8 billion by 2029, showing its increasing significance in the trends in fintech industry and the broader fintech industry trends landscape.

2. Artificial Intelligence (AI) and Machine Learning: Enhancing Decision-Making and Personalization

Artificial intelligence and machine learning are increasingly becoming part of financial services, providing features such as predictive analytics, risk management, and customized customer experiences. Financial institutions are using AI to process large volumes of data, making credit scoring more accurate, detecting fraud, and automating customer service.

For example, AI-powered chatbots can manage customer queries effectively, minimizing the intervention of humans. Firms such as H2O.ai and Data Robot are delivering advanced machine learning solutions specifically geared toward financial organizations, reflecting the industry’s shift towards automation and data-driven solutions. These AI applications align with fintech trends that are transforming how financial institutions operate in fintech 2025.

3. Open Banking: Fostering Collaboration and Innovation

Open banking refers to a process in which traditional banks and other financial institutions open up third-party providers’ access to consumer data on banking, transactions, and other financial transactions via application programming interfaces (APIs). By being open, this encourages interaction between traditional banking institutions and fintech firms to create innovative services and products in the financial space.

Consumers get customized financial management tools, whereas businesses can deliver more personalized services. Adoption of open banking is likely to pick up speed, with increasing institutions realizing its potential to spur customer engagement and growth, making it one of the current trends in fintech shaping fintech industry trends today.

4. Regulatory Technology (Reg. Tech): Streamlining Compliance and Risk Management

Efficient Compliance and Risk Management Financial institutions are relying on Reg Tech solutions to tackle compliance effectively as regulatory demands increase in complexity. Trends in fintech industry show that Reg Tech applies technology to monitor transactions, measure risks, and ensure regulatory compliance, lightening the load for compliance teams.

For instance, AI-powered platforms are able to process transactional data in real-time to flag suspicious behavior to help with anti-money laundering activities. The Reg Tech market size is expected to increase from $8 billion in 2022 to close to $45 billion by 2030, marking its significance in the future of finance. Fintech industry trends indicate that as regulatory frameworks tighten, Reg Tech adoption will continue to grow.

5. Decentralized Finance (DeFi): Redefining Financial Services

Reshaping Financial Services DeFi utilizes blockchain technology to provide financial services without the intermediaries of conventional banks. It allows lending, borrowing, and trading to be conducted via decentralized platforms, with the user having more ownership over their assets. Current trends in fintech highlight how DeFi growth is revolutionizing the financial sector by providing alternatives to mainstream banking services, including lower fees and greater accessibility.

It also raises challenges in areas of regulation and security that must be met as the industry matures. Fintech 2025 discussions suggest that DeFi will continue evolving, shaping the next wave of fintech industry trends with its decentralized nature.

6. Cybersecurity and Fraud Prevention: Safeguarding Digital Finance

With the rising digitization of financial services, cybersecurity is the priority. Banks are spending money on sophisticated security solutions, such as AI-powered threat detection and biometric verification, to counter cyber threats. The growth in digital identity verification technologies is also preventing identity fraud, ensuring only genuine people get access to financial services. As cyber threats are constantly changing, ongoing innovation in security protocols is needed to uphold trust in digital financial systems.

Current trends in fintech show that cybersecurity investment is a top concern, as fintech businesses strive to strengthen fraud prevention. The trends in fintech industry indicate that companies focusing on AI-based security solutions will dominate fintech 2025 developments.

7. Sustainable and Green Fintech: Promoting Environmental Responsibility

Sustainability is increasingly an area of interest for fintech, with businesses creating solutions that enhance environmental sustainability. Fintech trends are shifting towards green fintech, which involves carbon footprint tracking embedded in banking mobile apps, making environmentally friendly investment choices available, and backing renewable energy initiatives with innovative funding strategies.

Aspiration and Clarity AI are some of the pioneering companies with services that harmonize financial operations with environmental objectives, as a general trend towards sustainability is unfolding within the financial industry. Current trends in fintech highlight how environmental responsibility is influencing investment strategies, making it a key area of fintech industry trends.

Also read about Fintech app development trends.

8. Financial Super Apps: Consolidating Services into Single Platforms

Financial super apps are all about aggregating several financial services into one platform, enabling customers to manage many aspects of their financial lives at ease. Trends in fintech industry suggest that super apps are becoming dominant, as users prefer integrated platforms over standalone services.

Such apps can bundle banking, investing, insurance, and others together, offering consumers a one-stop-shop. Current trends in fintech indicate that companies investing in user-friendly super apps will lead the fintech 2025 landscape. Firms capable of uniting a range of different services together as an engaging user experience are going to head this movement.

9. Digital Currencies and Central Bank Digital Currencies (CBDCs): Transforming Payments

Cryptocurrencies and digital currencies, specifically CBDCs, are taking root as replacement currencies for classical payment instruments. Fintech 2025 discussions suggest that CBDCs will become more mainstream as governments and banks develop digital alternatives. Fintech trends indicate that central banks are launching their digital currencies to improve payment convenience and accessibility.

Governments across the globe are discussing or have implemented CBDCs, indicating movement towards a more digital monetary world. Bringing digital currencies within the mainstream finance framework promises innovation but demands attention from regulatory and security aspects as well. Trends in fintech industry suggest that CBDCs will drive digital transformation in payments, making them a critical element of fintech industry trends.

10. Quantum Computing: Preparing for Future Technological Shifts

Quantum computing is a relatively young field, yet it’s already on the radar of fintech businesses because of its enormous potential. Although quantum computers aren’t used on a large scale yet, trends in fintech industry indicate that businesses are already making plans for their eventual contribution. Fintech 2025 projections suggest that quantum computing could redefine areas such as portfolio optimization, risk analysis, fraud detection, and algorithmic trading.

Current trends in fintech show that companies like JPMorgan Chase and Goldman Sachs are investing in quantum computing research, positioning themselves ahead in the next generation of fintech industry trends. However, quantum computing also presents security risks, making the development of quantum-safe cryptography a crucial aspect of fintech trends moving forward.

11. Hyper-Personalization in Financial Services

The fintech trends currently lean heavily towards hyper-personalization. This is the process of employing sophisticated data analytics and AI to deliver extremely personalized financial products and experiences to customers. Banks and fintech firms have always gathered a tremendous amount of data, but trends in fintech industry today are all about leveraging that data to understand individual customer behaviors and needs.

For instance, fintech trends now enable businesses to forecast precisely when consumers may be prepared for a loan or a fresh investment opportunity and actively present solutions specifically for them. Hyper-personalization not only raises customer satisfaction but also fuels loyalty and revenue expansion. Affirm and Klarna are great examples—both of them are extremely successful by presenting customized financial options at the very moment customers require them.

App Cost Calculator: Calculate the cost of Fintech app development

12. Biometric Authentication and Advanced Security

Security remains among the top priorities in current trends in fintech. As more financial services move online, the potential for cyberattacks grows. It is for this reason that biometric authentication is becoming a common practice in the fintech industry trends. Biometric authentication encompasses fingerprint scanning, face recognition, and even voice identification, offering significantly more secure and convenient methods for customers than PINs or passwords.

This method dramatically lowers fraud risk, particularly in high-risk financial transactions. Large fintech players such as PayPal and Apple Pay have effectively integrated biometric solutions, increasing consumer trust. Looking ahead to fintech 2025, biometric authentication isn’t optional anymore—it’s a necessity for fintech companies looking to offer secure, reliable services.

13. Cross-Border Payments Simplification

Streamlining cross-border payments is another significant area where fintech 2025 is taking giant leaps. Traditionally, international transactions were costly, time-consuming, and cumbersome. But trends in fintech industry are now revolutionizing this sector by leveraging blockchain technology, AI, and enhanced payment rails. Firms such as Wise (formerly TransferWise), Ripple, and Payoneer are developing simpler, lower-cost, and quicker solutions that go beyond conventional banking systems.

Companies that transact globally profit immensely, benefiting from lower fees and faster transactions. By fintech 2025, eased cross-border transactions may become standard, revolutionizing global trade practices and allowing small businesses to compete more effectively on a global level.

14. Regulatory Sandboxes for Fintech Innovation

One of the most important fintech industry trends that is not technological but equally powerful is the emergence of regulatory sandboxes. These are regulated environments established by financial regulators where fintech firms can pilot new products and services in a secure manner without intense regulatory burdens. Regulatory sandboxes promote innovation and give clear direction, making it simpler for fintech startups to bring new concepts to the market.

Regulatory sandboxes are already running in nations such as the UK, Singapore, and the US, and this current trend in fintech is gaining traction worldwide. Fintech businesses benefit by validating their concepts promptly, ensuring compliance, and bringing products to market faster, making this trend a significant force in the trends in fintech industry.

15. The Rise of Buy Now Pay Later (BNPL)

Buy Now Pay Later (BNPL) remains one of the defining fintech trends heading into fintech 2025. Although not entirely new, its expansion is still staggering. BNPL allows consumers to pay in installments with no interest or steep fees, increasing sales conversions exponentially. Afterpay, Klarna, and Affirm have made BNPL mainstream, and their success is prompting traditional banks to offer similar options.

BNPL is particularly attractive to younger consumers, who prefer flexible credit options and often avoid traditional credit card debt. As fintech industry trends evolve, BNPL will continue to develop, with credit-risk analysis becoming even more sophisticated and lending decisions becoming more data-driven.

Conclusion

The current trends in fintech heading into fintech 2025 reveal a technology-driven financial industry focused on collaboration, security, and customer-oriented solutions. Companies leveraging embedded finance, AI-powered personalization, open banking, and sophisticated cybersecurity will stand out.

As trends in fintech industry continue to shape the sector, companies must adapt strategically, embrace innovation, and effectively manage risk to thrive in this evolving financial services arena.

Written by: Nauman Pathan

Nauman Pathan is a Project Manager at Groovy Web - a top mobile & web app development company. He is actively growing, learning new things, and adapting to new roles and responsibilities at every step. Aside from being a web app developer, he is highly admired for his project management skills by his clients.

Frequently Asked Questions

We hope these clear your doubts, but if you still have any questions, then feel free to write us on hello@groovyweb.coHow will artificial intelligence influence the future of fintech?

Embedded finance, AI-supported personalization, decentralized financing (DeFi), open banking, and regulatory technology are the engines driving Fintech 2025. These technologies are making financial services more efficient, secure, and are making them more accessible as well.

How important will decentralized finance (DeFi) be to fintech 2025?

Decentralized finance (DeFi) is changing the way financial services work by eliminating intermediaries, enabling borderless transactions, and supporting smart contract-based lending, borrowing, and investment. This increases financial inclusion and lowers costs.

Why is cybersecurity a paramount issue for fintech companies?

With more transactions happening digitally comes a host of cyber-attacks. The fintech industry is adopting AI-driven fraud prevention, biometric authentication, and blockchain security measures to protect users and ensure compliance with regulations.

How is embedded finance altering legacy banking?

Embedded finance refers to the integration of financial services such as lending and insurance into non-financial platforms, allowing for user convenience. Especially redefining what banking experience is by enabling lending, payments, and insurance within its application.

Related Blog

Rahul Motwani

Progressive Web Apps Development Guide: Benefits, Cost, Characteristics & Examples

Web App Development 06 Feb 2023 15 min read

Rahul Motwani

How Much Does It Cost to Get Your App on the App Store?

Mobile App Development 26 Dec 2024 9 min readSign up for the free Newsletter

For exclusive strategies not found on the blog